李宁中报高增同时报表质量飞跃性改善

作者:马莉陈腾曦林骥川

来源:纺服新消费马莉团队

投资要点

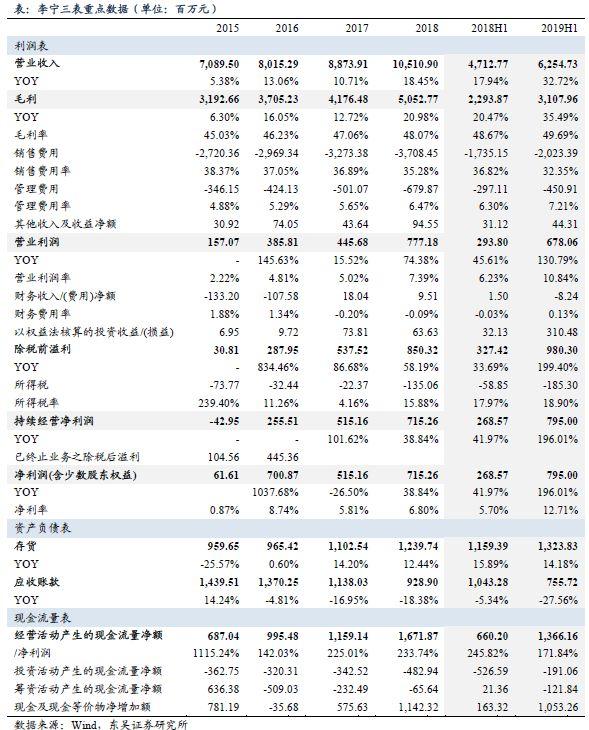

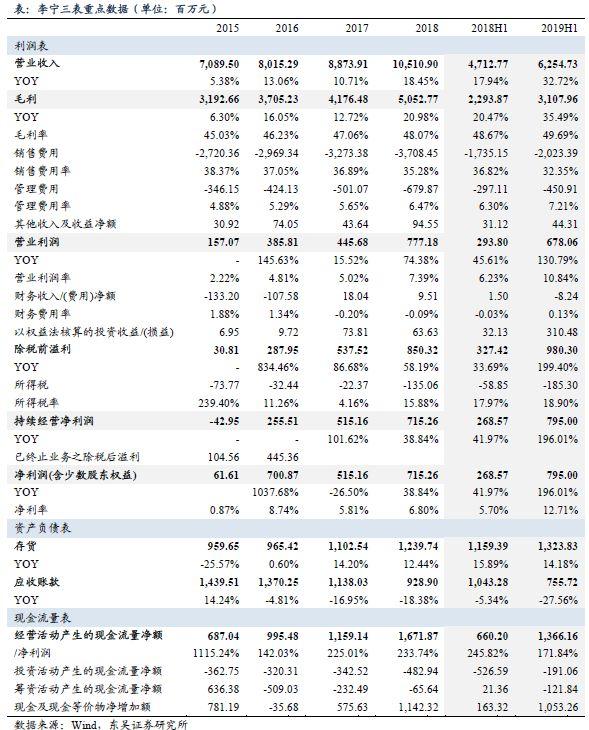

事件:公司公布中报,收入同增33%至62.55亿元,归母净利同增196%至7.95亿元,净利率由18H1的5.7%提升到12.7%,扣除一次性与经营无关损益后归母净利同增109%至5.61亿元。

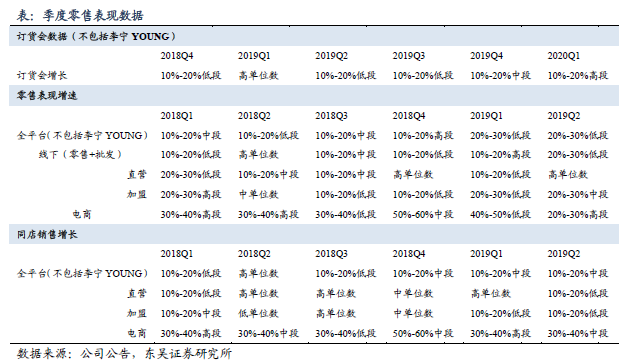

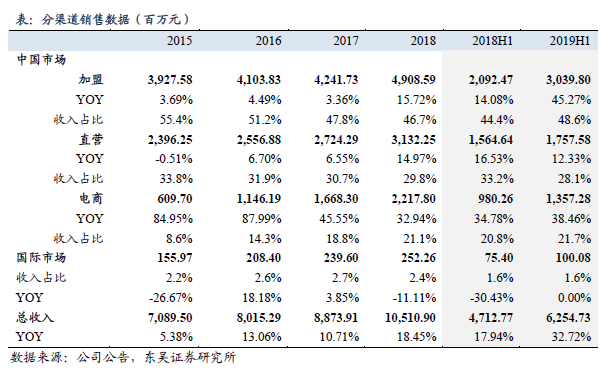

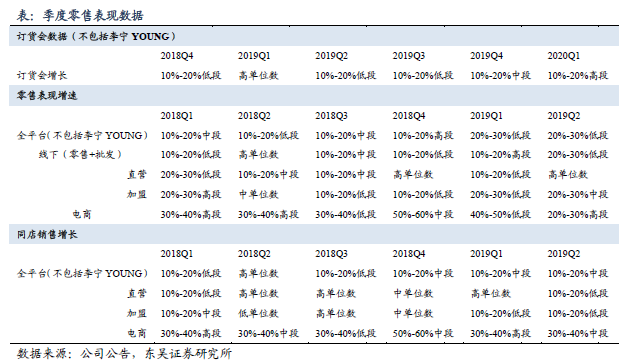

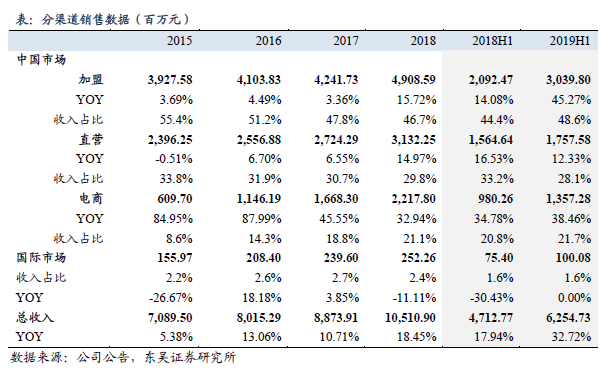

经销渠道及电商渠道的高增长是19H1收入高增31%的主要拉动力。

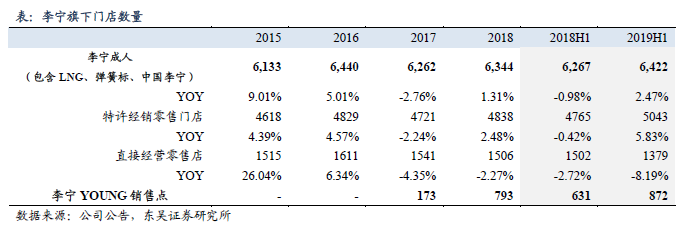

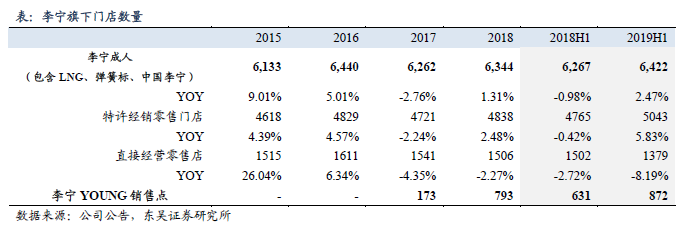

分渠道来看:1)经销业务报表收入同增45%至30.4亿元,零售收入19Q1/Q2分别同增20%-30%低段/中段,门店数量增长5.8%至5043家,可比同店增长10%-20%低段,报表收入增速显著快于零售增速主要由于批发折扣率改善以及部分自营店铺转为当地经销商经营;2)直营报表收入同增12%至17.6亿元,零售收入19Q1/Q2同增10%-20%低段/高单位数,增速下降与直营转加盟有关;3)线上报表收入同增38.5%至13.6亿元,溯系列为代表的电商专供产品线话题性及零售反馈良好。

分品类来看,篮球和运动时尚品类19H1增长分别达到54%及44%,是表现最为强势的品类;分品牌来看,最受关注的中国李宁系列门店从2018年末的23家店增加到70家,标杆门店如南京德基、成都IFS、上海来福士月均流水都超过100万元;李宁YOUNG品牌19H1门店净增79家达到872家,正处在以单店产出及盈利为核心的全面提效过程中。

毛利率提升叠加提效带来盈利能力进一步上行:毛利率在批发折扣率提升以及自营零售折扣率提升的背景下同比上行1pp达到49.7%,销售费用绝对值增长但费用率下降4.5pp至32.4%,由此虽然管理费用率受到产品开发及供应链部分的高管聘请及激励投入增加、计提商誉减值等原因上升0.9pp至7.2%,公司营业利润率仍实现同比提升4.6pp至10.8%,营业利润同增131%至6.8亿元,叠加红双喜土地收储带来的一次性收益2.7亿元,公司19H1归母净利同增196%至7.95亿元,扣除一次性损益影响归母净利同增109%至5.61亿元。

渠道库存周转加快明显,报表质量飞跃性提升。存货方面,周转天数由18H1的85天下降到74天,店铺存货周期从去年同期4.2个月下降到3.7个月,整体存货周期(包括店铺和仓库)存货周期从5.6个月下降到4.8个月,存货结构中库龄6个月或以下的货品占比从72%提升到74%;应收账款周转天数由18H1的42天下降到24天;受益营运资金占用下降,经营活动净现金流同比增长107%至13.7亿元,营运效率及资金使用效率实现跃升。

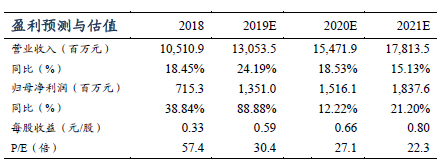

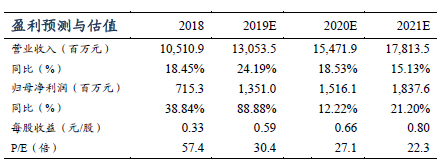

盈利预测及投资建议

公司仍处在收入健康增长同时运营效率不断提升的阶段,我们预计19/20/21收入同增24%/19%/15%至131/155/178亿元,同时2019年扣除一次性收益影响后净利率可达到8.5%-9%,若考虑一次性损益(约为19年贡献2.3亿利润),19/20/21归母净利同增89%/12%/21%至13.5/15.2/18.4亿元,对应估值30/27/22X,作为产品年轻化、管理精细化的龙头标杆企业值得持续关注,维持“增持”评级。

风险提示

李宁品牌或相关代言人影响力意外下降,YOUNG品牌拓展不及预期,中国李宁拓展不及预期

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.